who we are

The collegial and partnership structure of SAMMERSEIDLER.de justifies the high quality of our work. Each client of SAMMERSEIDLER.de is in direct contact with an independent partner.

The aim is to protect the capital of the clients in the long term and at the same time to generate a positive performance. We try every day to continue the described process at the highest level. This is the key to our success. The high level of discipline leads us to a sustainable and long-term relationship with the client.

“Our client is the most important person in our company, whether he’s there in person, writing or phoning. It is not an interruption of our work, but its purpose.

Our client does not depend on us, we depend on him. He only gives us lasting trust if we justify it every day.

Our client is a living part of our business and not an outsider. We do not do him a favor by honestly and competently advising him, but he does us a favor by giving us the opportunity.

Our client is someone who calls us his wishes. Our job is to fulfill these wishes for Him and us.

In order to meet these requirements, the individual partners have degrees as a banker, economist and in-depth financial education such. as CFP® – Certified Financial Planner, ….

You will find us as accredited and registered members of the Financial Planner Board (as an accredited CFP® – Certified Financial Planner) as well as auditors certified as DIN ISO 22222. This allows us, through the most comprehensive and highest education in finance, to a full range of advice and obliged us by regular training to maintain this high standard.

Our Business Principles

Our business principles form the basis for our actions. We are committed to this across all business areas. To live this is the claim. We want to be measured by that

customer interests

Customer interests come first. Our success follows that of our customers.

customer focus

Achieving unrestricted customer satisfaction. We listen to you and try to exceed the expectations of our customers whenever possible

Creation of recognizable added value and added value for our customers

Development of innovative solutions for the benefit of our customers

Independence

Independence in the consultation determines our thinking and acting.

trust and integrity

Trust and integrity are the foundation of our business.

Ethically and socially flawless behavior in all business and financial matters.

Respectful action towards all customers, employees and business partners at all times. Responsible use of the environment and natural resources.

Quality

Delivering reliable quality and punctual results.

Use of the most suitable techniques and methods, as well as state-of-the-art technology. Continuous search for process improvements and optimizations.

Competence and Team Spirit

Employment of competent and committed employees.

Constant training of our employees and individual development opportunities.

Recognition and promotion of outstanding achievements.

A commitment to the highest quality

We are committed to the highest quality services and professional advice from highly qualified personnel.

Constant Innovation

Further development of our know-how and consistent use of technological progress.

Transparency

Transparency is our claim.

Experience and Sustainability

We see decades of experience as the basis for sustainability over generations.

SAMMERSEIDLER.de is an independent, owner-managed financial advisory firm that specializes in financial optimization and individual asset management of high-net-worth individuals and advises its clients in accordance with the principles of proper financial planning (GoF).

With the possibility of our individualized fee model, we vouch for our independence from being free from any third-party interests as well as from commission-oriented sales approaches.

SAMMERSEIDLER.de commits itself, in the interest of its clients, to the applicable ethics rules of the FPSB, Financial Planners Standards Board Germany. (www.fpsb.de) to act.

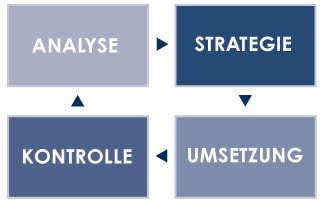

In accordance with our standards of independence, transparency and performance, the individual interests of our clientele are always at the center of our advice and our entrepreneurial activities. In close consultation with our clients, we develop comprehensive solutions for your personal asset management on the basis of comprehensive financial plans. Continuous dialogue with our clients, their tax advisers, lawyers and notaries enables us to have flexible financial planning that not only reacts quickly and efficiently to market dynamics, but is also one step ahead of market movements in terms of security.

5000/5000

Zeichenbeschränkung: 5000

Through regular training of our consultants, we ensure our expertise in a sustainable manner and thus ensure that we are able to respond with focus and responsibility to current market developments, product changes as well as legal and tax reforms in a target group-focused manner. We guarantee tailor-made cash investment models that enable our clients to always act à jour.

Our claim to responsible financial advice is rounded off by a complete, easy-to-understand documentation that can be traced at any time.

The advisory mandate

Our advisory mandate is the ideal model for clients who only want to make selective use of our consulting services without having to forego an independent product portfolio and the highest quality.

For those of our clients who do not want to realize a holistic long-term financial plan, but only one-time plans, we offer an excellent variety of securities, corporate investments, insurance models, financing offers and special solutions for individual needs. In addition, the advisory mandate includes, for example, the optimal structuring of estate succession and possible real estate projects as well as the improvement of personal retirement and wealth management or the reorganization of securities accounts. We offer these services to the well-known, customary commissions conditions.

Our best-advice approach guarantees that we can always offer our clients the optimum product variant for their personal needs and interests. To ensure this continuously, we work together with a well-developed network of experts.

The Financial Planning Mandate

The majority of our clients have opted for the financial planning mandate, in the course of which we provide long-term advice and support with individually tailored, holistic financial plans. In close consultation with our clients, their tax advisors and lawyers, we determine actual and target status, personal wishes and goals, existing assets and possible investment volumes. As a result of a comprehensive consideration and conscientious examination of all parameters, we develop an individual financial plan that, in consultation with our clients, forms the basis for our subsequent research of the appropriate products. We support our clientele continuously and in the long term in the implementation of our recommendations.

At regular intervals, we record the recurrent individual agenda of our clients and compare them to improve the results with each specific life context. In addition, we monitor all investments and constantly review their value. Thus, we prevent supply gaps and bad investments as well as overinsurance.

A fixed consulting fee is payable for our financial planning mandate. In addition to the services already mentioned, this includes extensive, individual discounts on commissions and brokerage due to the reduced procurement costs. As a result of the higher investment costs, the savings in procurement costs allow us to achieve a higher return than in the classic, commission-oriented approach – in favor of increased transparency and in the interest of our clients.

The financial planning mandate is recommended for those who want comprehensive advice, complete documentation and individual, sustainable and economically stable asset management. Like all our services, this mandate is based on trusting and responsible cooperation.

Financial planning is life planning – more than ever today!

Financial planning in the personal sphere has the goal of building up and securing assets over the long term. The tempting offerings of the investment industry are opposed by fluctuating markets and tax changes, so that targeted profits can quickly turn into losses. For this reason, you should seek the help of qualified financial experts for private financial and asset planning who not only want to generate short-term profits for their clients, but also plan and provide organizational support for the long-term accumulation of assets and financial security until retirement. Finally, the transfer of wealth to the next generation should not be accidentally regulated, but planned.

The Financial Planning Standards Board Germany e.V. is the union of more than 1,400 private financial planners and estate planners who represent the highest level of quality in this industry after their training, experience and constantly updated expertise. They bear the title “Certified Financial Planner®”, abbreviated CFP®, or”Certified Foundation and Estate Planner®”, abbreviated CFEP®. They are part of a worldwide organization that now has around 138,000 members in the 24 most important economies.

qualification

Qualification as a CFP certificate holder or as a CFEP certificate holder follows the International Rule of Law, the “4-E Rule”: Education, Examination, Experience (years of experience as a financial services provider) and Ethics (commitment to high ethical standards ). The first two “E’s” are only fulfilled with the proof of an extra-occupational training course with a corresponding degree and after passing a central examination of the Financial Planning Standards Board Germany e.V. Three years of activity in the area of finances of private clients, at least one year as financial planner or estate planner, must be proven for the third “E”. An impeccable reputation and the commitment to the rules of the Financial Planning Standards Board Germany e.V., which includes the submission to a court of honor, fulfill the fourth “E”.

The Family Office mandate

For very wealthy clients, we offer our Family Office mandate. It includes all the services of the financial planning mandate as well as the support and controlling of foreign deposits and other assets. In addition, together with external experts, we also design asset and company successions.

By uninterrupted detection, we give Family Office clients full repayment of all procurement and administrative costs of the products brokered by us, thereby ensuring the maximum investment intensity of all assets.

Family Office clients pay a staggered, percentage fee on all our monitored and brokered investments. This is calculated and settled monthly on an annual average basis. In this way, we take part in the management of these mandates in the economic development of assets and thus take over part of the economic risk.

Due to the considerable effort involved in providing this mandate, we only offer this service after a certain minimum size of your assets. Please contact us for further information. [/ Text_output]